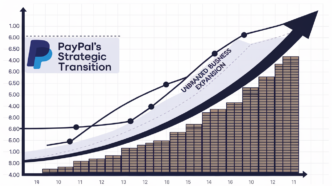

PayPal’s Strategic Transition Impacts Unbranded Business Expansion

PayPal, a prominent digital payment network, has announced a deceleration in the expansion of its unbranded business area. The corporation ascribes its reduction to a calculated strategic transition focused on improving profitability instead of pursuing ambitious expansion. This action has raised investor apprehensions, resulting in a 10% decline in PayPal’s stock value.

This article examines the rationale for PayPal’s strategy transition, its consequences for its business model, and the wider effects on the digital payments sector.

1. What constitutes PayPal’s unbranded business?

PayPal functions via two primary business models:

1.1 Branded Enterprise

Entails PayPal’s conventional payment services, wherein clients utilize PayPal accounts to execute transactions.

Identifiable via PayPal’s checkout button on online retail platforms.

1.2 Unbranded Business Encompasses PayPal’s white-label payment processing products, including Braintree, enabling businesses to

execute transactions without showcasing the brand.

Competes with prominent payment processors such as Stripe, Square, and Adyen.

The unbranded market has been a major catalyst for growth, especially for large organizations desiring seamless and customizable payment options.

2. What is the rationale for PayPal’s shift in focus?

The deceleration in PayPal’s unbranded business expansion is intentional; it stems from a deliberate strategic realignment.

2.1 Emphasising Profitability Rather Than Growth

PayPal has redirected its emphasis from volume-driven growth to transactions with elevated profit margins.

The organization is prioritizing relationships and income sources that enhance overall profitability.

2.2 Fierce Competition in Payment Processing

The payment processing sector has grown intensely competitive, with competitors like Stripe and Adyen providing reduced prices and creative solutions.

To sustain profitability, PayPal is prioritizing quality over number in its commercial partnerships.

2.3 Adjusting to Market Trends

Amid increasing interest rates and economic concerns, investors prefer enterprises demonstrating sustainable profitability above mere revenue growth.

PayPal’s action corresponds with market anticipations for enhanced financial fundamentals.

3. What Impact Has This Had on PayPal’s Stock?

After the disclosure of diminished growth in unbranded business, PayPal’s shares declined by 10%, indicating investor apprehensions regarding the company’s prospective revenue sources.

3.1 Responses from Investors

Investors are concerned that a reduction in unbranded payments may diminish PayPal’s total transaction volume.

Certain observers contend that PayPal requires a more robust strategy to contend with potential fintech challengers.

3.2 Impact of Market Competition

Stripe and Adyen have been developing rapidly, obtaining significant contracts with technology leaders and merchants.

PayPal’s cautious strategy may lead to a decline in market share if rivals persist in advancing more rapidly.

4. Prospective Consequences for the Digital Payments Sector

PayPal’s strategic transition indicates significant transformations in the digital payments sector.

4.1 Will Other Corporations Imitate This Approach?

If PayPal’s emphasis on profitability is effective, other payment providers may emulate similar strategies.

Nevertheless, firms such as Stripe and Adyen persist in prioritizing market expansion and innovation, hence developing divergent strategies.

4.2 Considerations for Merchants

Companies utilizing PayPal’s unbranded services may pursue alternative options offering superior pricing or flexibility.

Merchants will constantly monitor PayPal’s ability to sustain its competitive advantage in payment processing.

5. Conclusion

PayPal’s choice to emphasize profitability rather than aggressive growth in its unbranded business area has resulted in a varied market reaction. The strategy supports long-term financial stability; nevertheless, the recent decline in stock value and competition from other fintech companies raise worries regarding PayPal’s capacity to sustain its leadership in the payment processing sector.

As digital payments progress, PayPal must reconcile profitability with innovation to maintain a competitive edge in a swiftly evolving financial environment.